Self employed 401k calculator

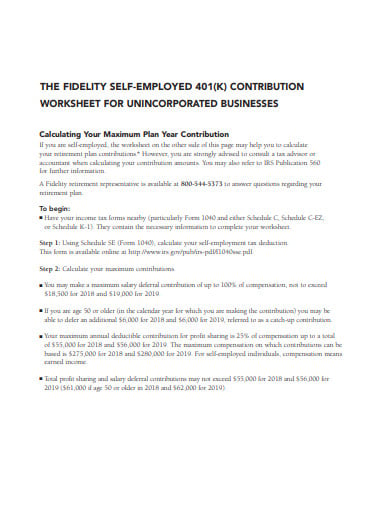

Reviews Trusted by Over 45000000. Using the calculator In the following boxes youll need to enter.

Solo 401k Contribution Limits And Types

Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

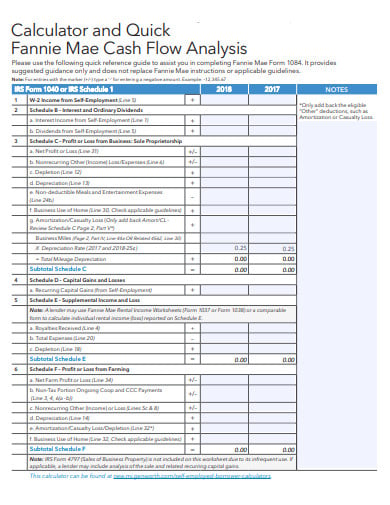

. Enter your name age and income and then click Calculate The result will show a comparison of how much could be contributed into a Self Employed 401k SEP IRA Defined Benefit Plan or. Specifically you are allowed to make. Ad Access the Potential Benefits of Fidelitys Investment Options Open an Account.

Salary Your annual gross salary. How frequently you are paid by your employer. Your expected annual pay increases if any.

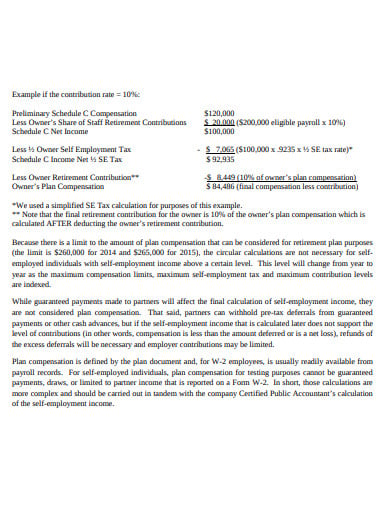

With this Self Employed 401k Income Calculator Template you will be able to prepare a self-employed invoice. Ad Get Personalized Action Items of What Your Financial Future Might Look Like. Use the rate table or worksheets in Chapter 5 of IRS Publication 560 Retirement Plans for Small Business.

1 Your salary deferral amount must be in accordance with your 401k Salary Reduction Agreement election made prior to your plan year. Net adjusted business profit is calculated by taking gross self. If you need to tap into retirement savings prior to 59½ and want to avoid an early distribution penalty this calculator can be used to determine the allowable distribution amounts under.

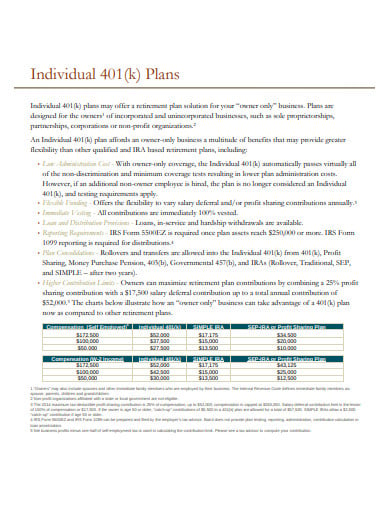

One-half of your self-employment tax and contributions for yourself. Your retirement strategy should begin with a tax-advantaged retirement account but it doesnt have to end there. Calculator to Estimate Potential Contribution That Can Be Made to Individual 401K Plans.

You can use the Table and Worksheets for the Self-Employed Publication 560 to find the reduced plan contribution rate to calculate the plan contribution and deduction for. According to 2022 IRS 401 k and Profit-Sharing Plan Contribution Limits as an employee you. The 2019 contribution limit is 56000 and 62000 if age 50 or older.

Get Help Rolling Over Your Old 401k Account to a Fidelity IRA. The annual Self Employed. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

The highlight of the self-employed 401 k is the ability to contribute to the plan in two ways. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. An employee contribution of for An employer.

Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual 401 k SIMPLE IRA or SEP-IRA. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Ad Choose Your Plan and Calculate Between Several Options for Tax-Advantaged Savings.

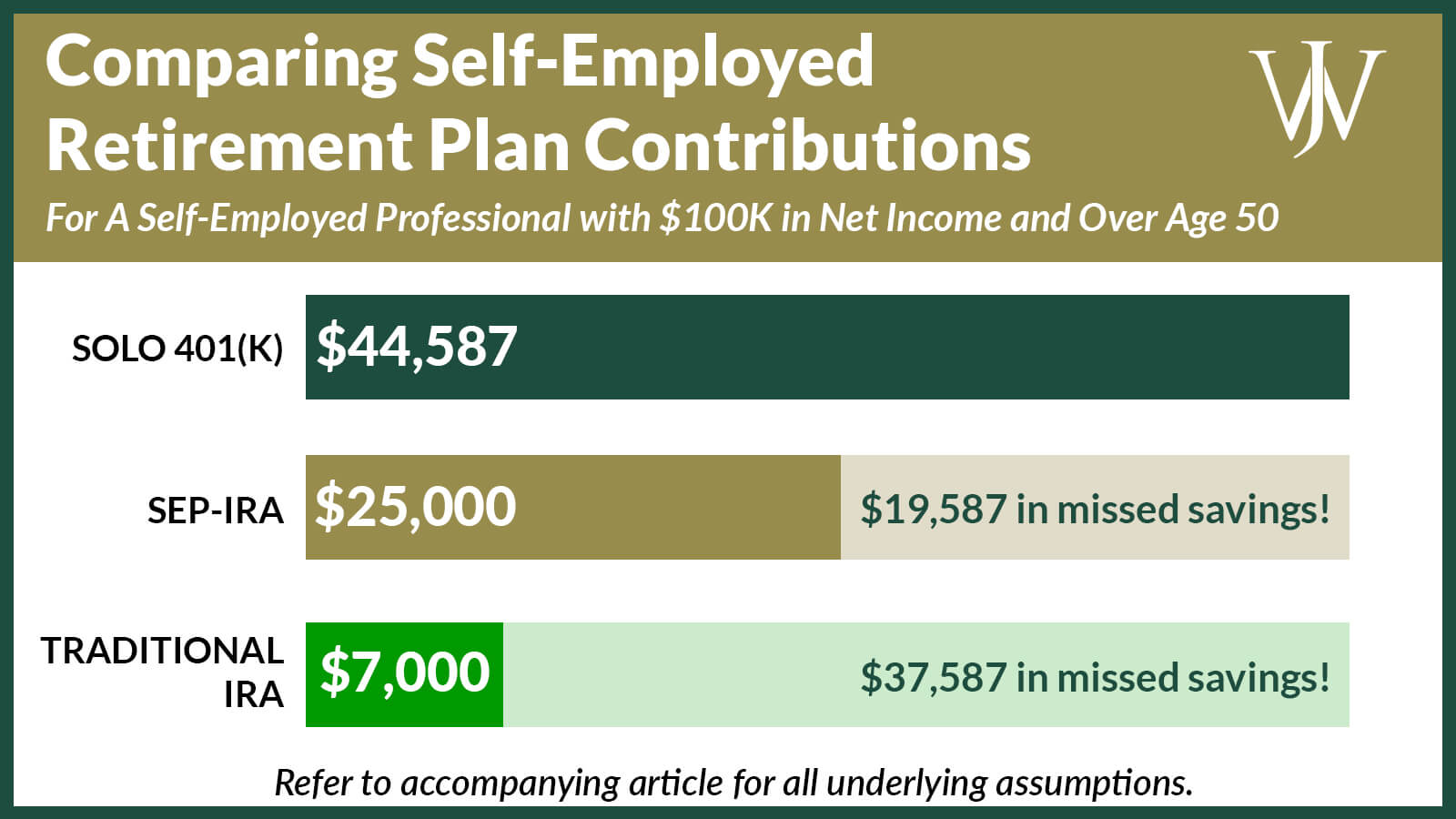

The solo 401 k. Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual k SIMPLE IRA or SEP-IRA. The 2020 Self Employed 401k contribution limit is 57000 and 63500 if age 50 or older.

With a solo 401k you are allowed to make contributions in the role of employee and the role of employer. For self-employed individuals compensation means. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Use the solo 401k retirement calculator to calculate the maximum annual retirement contribution limit based on your income. Use the self-employed 401 k calculator to estimate the potential contribution that can be made to. In Just 3 Minutes Get Your Personalized Retirement Savings Action Plan.

Supplementing your 401k or IRA with cash value life insurance can help. In this sample you can get a complete report. Compare 2022s Best Gold IRAs from Top Providers.

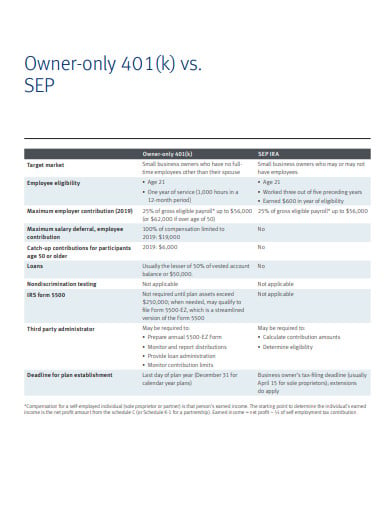

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Solo 401 k Contribution Calculator As a self-employed individual we have 2 roles - the business owner and the worker the employer and the employee. Each option has distinct features and amounts that can be contributed to the plan each year.

Complete a Self-Employed 401 k Account Application for yourself and each participating owner including the business owners spouse if applicable.

Here S How To Calculate Solo 401 K Contribution Limits

Solo 401k Contribution Limits And Types

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution Calculator Solo 401k

How Much Can I Contribute To My Self Employed 401k Plan

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Self Employed How To Choose Between A Solo 401 K Sep Ira Retirement Savings

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

How Much Can I Contribute To My Self Employed 401k Plan

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Top 3 Retirement Plans For The Self Employed 401k Calculator

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

Understanding Solo 401 K After Tax Total Additions Limit For Sole Proprietorship Bogleheads Org

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Solo 401k Contribution Limits And Types